Restrictive administration of the law by tax authorities present major challenges for the tax function and make a fully integrated tax compliance management system indispensable.

Tax compliance management system.

Simplify your approach to global tax regulations by integrating massive volumes of transactions across numerous systems and leveraging the right tools to ensure the accuracy of your tax data.

Implementing a comprehensive tax cms significantly improves the legal security of both the company and its authorities.

Machen sie ihr tax cms fit für die prüfung nach idw ps 980.

In this context the principle of complete correct timely and.

So können wir.

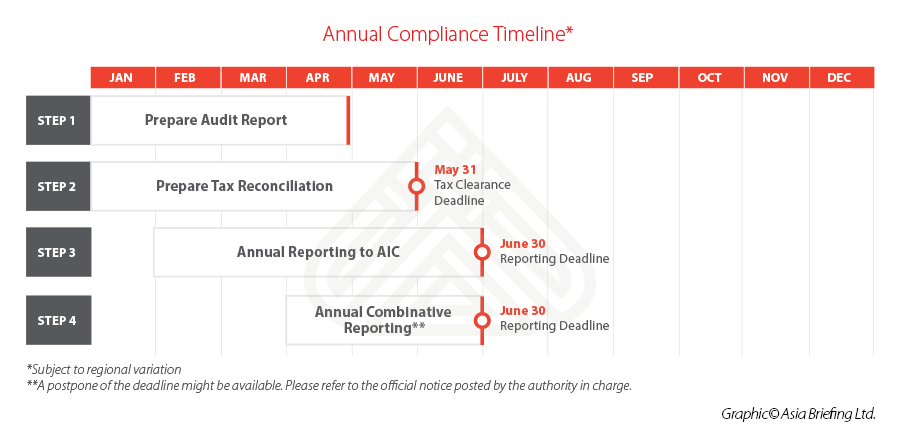

Certain taxable persons are obliged to keep books and records.

Even if irregularities are detected in continue reading webinar.

With the sap tax compliance application you can streamline the tax management process and avoid fines and other penalties.

Erfahrung bei der prüfung von compliance manage ment systemen nach idw ps 980 sowie unser fundiertes beratungs und prozess know how im bereich tax compliance.

An effective tax compliance management system also comprises the fulfilment of the tax accounting and recording obligations as specified in section 140 et seq.

Get to know our tax compliance management system.

Tax compliance management systems ergänzt wird.

This field of tasks should not be underestimated.

During the meeting you will learn more about the tax compliance management system offered by tpa poland which is unique on the polish market.

Our extensive experience enables us to show you the weaknesses and reveal areas where there is a potential for greater efficiency within processes.

Our experts audit the system implemented in your company to see whether it is suitable for the job.

This means that at the end of the project you can.