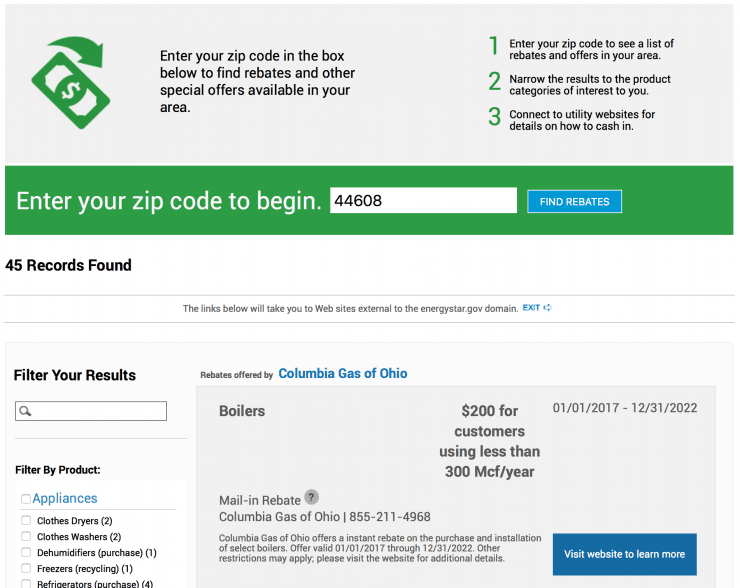

However many state and local governments and utility companies offer incentives or rebates for energy or water saving home improvements.

Tax deductible energy star appliances.

After 2019 the credit sees its value gradually increased until 2021 when it will need to be renewed by congress or it will disappear entirely.

To verify tax credit eligibility ask your hvac contractor to provide the manufacturer certification statement for the equipment you plan to purchase.

One of these incentives is the energy efficient tax credit.

Federal income tax credits and other incentives for energy efficiency.

If you purchase an energy efficient appliance dishwasher refrigerator dryer you can claim this tax credit when.

The federal government provides tax relief to taxpayers doing their share to reduce global warming.

There s a lot of misinformation regarding whether the residential energy tax credit is still available or not.

This is known as the residential renewable energy tax credit.

While energy star supplies some information about tax.

Federal income tax credits and other incentives for energy efficiency.

Learn more about this program and how you may benefit from it.

Taxpayers who made certain energy efficient improvements to their home last year may qualify for a tax credit this year.

In addition to tax deductions for the purchase of new appliances you can deduct amounts from your income taxes for appliances donated to charities.

In past years as an incentive to conserve energy at home the federal government has offered tax credits to homeowners who purchase energy efficient appliances.

How to deduct new appliances from taxes.

However beginning in 2012 the program has mostly expired except for credits geared at the production of residential energy.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

You can t claim energy star appliances or water saving improvements like low flow toilets low flow shower heads or xeriscaping on your federal return.

Irs tax tip 2017 21 february 28 2017.

To put it simply it s still available in its entirety until 2019.

Solar wind geothermal and fuel cell technology are all eligible.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

You could deduct 100 of energy related property.

Air conditioners recognized as energy star most efficient meet the requirements for this tax credit.

For more information see.

Here are some key facts to know about home energy tax credits.

Homeowners can claim a federal tax credit for making certain improvements to their homes or installing appliances that are designed to boost energy efficiency.

Non business energy property credit.